Richard Helms - Wikipedia

https://en.wikipedia.org/wiki/Richard_Helms

Richard

McGarrah Helms (March 30, 1913 – October 23, 2002) served as the United

States ... Helms then served as DCI under Presidents Johnson and Nixon. .... At CIA Helms was its first Director to 'rise through the ranks'. ..... Unfortunately, in its strategy of fighting fire with fire, forces in the Phoenix program used torture,

James Comey Fired: Why Firing Is Compared to Richard Nixon

time.com › Politics › FBI

May 9, 2017 - Trump's dramatic termination of FBI director James Comey has historical echoes to Richard Nixon's Saturday Night Massacre.

Richard Nixon also fired the person investigating his presidential - Vox

https://www.vox.com/.../saturday-night-massacre-explained-nixon-watergate-archibal...

May 10, 2017 - On Tuesday evening, after President Donald Trump abruptly fired FBI .... Haldeman and Nixon, days after the break-in, discuss using the CIA to ...

Donald Trump has committed the exact offense that forced Richard ...

https://www.vox.com/.../5/.../trump-comey-firing-obstruction-justice-nixon-watergate

Begin quote from:

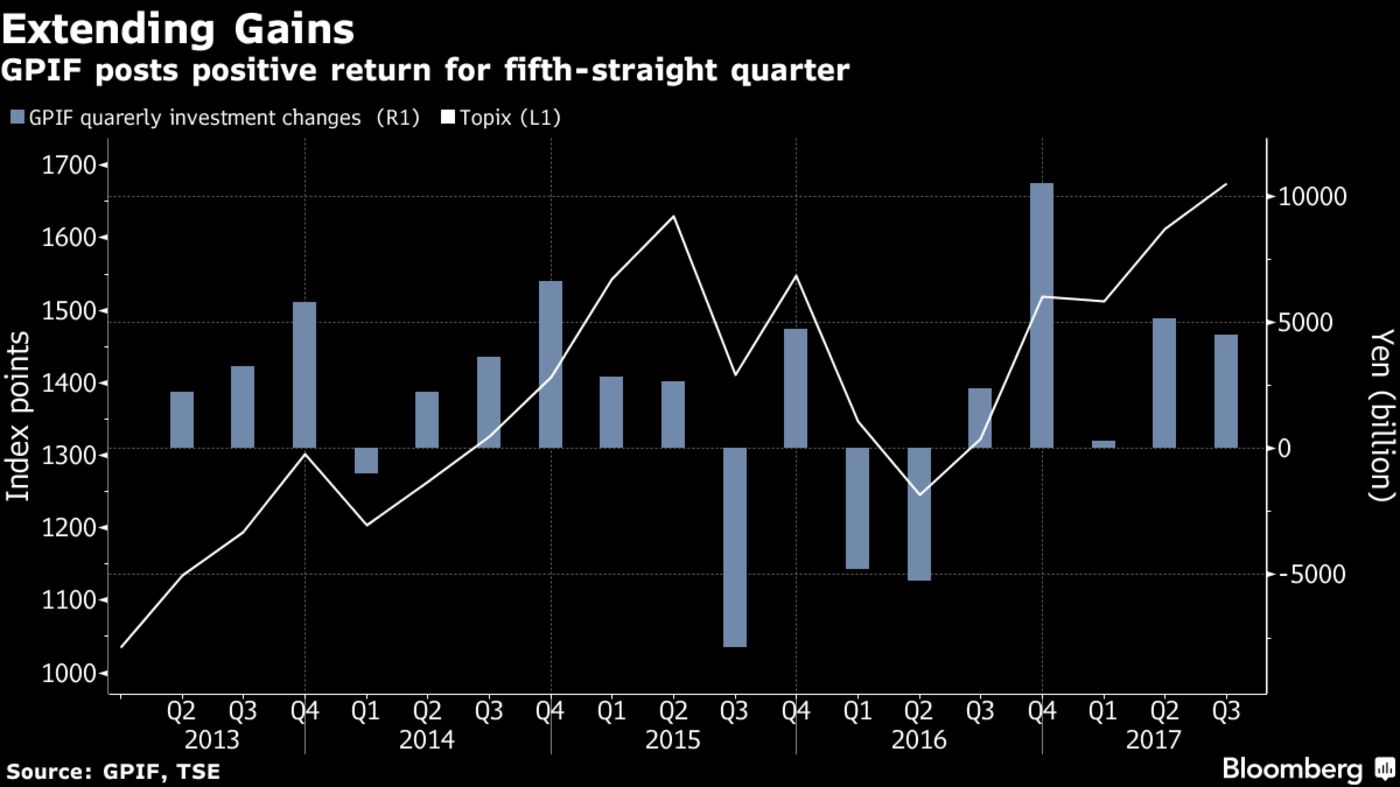

World's Biggest Pension Fund Adds $39 Billion as Stocks Rise

The

world’s biggest pension fund posted its fifth-straight quarterly gain,

the longest run in more than two years, as global stocks advanced to new

highs and …

Photographer: Tomohiro Ohsumi/Bloomberg

World's Biggest Pension Fund Adds $39 Billion as Stocks Rise

By , , and

Updated on

-

Rise in Japanese, global stocks plus weaker yen boost returns

-

GPIF’s total assets increase to record 156.8 trillion yen

Japan’s Government Pension Investment Fund returned 3 percent, or 4.5 trillion yen ($39 billion), in the three months ended Sept. 30, increasing assets to a record 156.8 trillion yen, it said in Tokyo on Thursday. Domestic equities added 1.8 trillion yen as the value of foreign equities increased by 2 trillion yen, particularly boosted by the euro’s strength.

Prospects for higher corporate earnings have driven the Topix index to levels unseen in more than a decade, while U.S. stock benchmarks climbed to records on confidence the world’s largest economy will sustain its growth. GPIF’s string of gains follows a series of losses after it overhauled its strategy in 2014 to buy more shares and cut debt.

“Their investment itself is going well, and going forward I don’t expect a lot of movement from them that would impact the market” said Koichi Kurose, Tokyo-based chief market strategist at Resona Bank Ltd. “Japanese stocks have been rising so there’s a possibility GPIF will sell to balance their portfolio, but right now I’m not hearing a lot of speculation on that.”

Read: Biggest Pension Fund Craves More After Foray Into ESG Assets (1)

“At GPIF we manage assets from a long-term perspective,” GPIF President Norihiro Takahashi said in a statement Thursday.

The fund’s domestic bond holdings, which accounted for 28.5 percent of total assets, posted a 0.2 percent gain. Foreign bonds added 2.5 percent, making up 14 percent of GPIF’s investments at the end of September.

Japanese stocks accounted for 24 percent of holdings, while overseas equities were 24 percent of assets. The target levels for GPIF’s portfolio are 35 percent for domestic debt, 15 percent for foreign bonds, and 25 percent each for domestic and overseas shares. The percentage allocations for foreign bonds, overseas stocks and short-term assets were all at record highs.

Alternative assets accounted for 0.1 percent of GPIF holdings, below the allowable limit of 5 percent. The fund has also invested around 1 trillion yen into indexes that track Japanese stocks with high environmental, social and corporate governance scores. GPIF announced Wednesday that it plans to consider investing in environmental indexes covering Japanese and foreign stocks.

“On ESG, GPIF is taking the lead, trying to create benchmarks for others,” said Resona’s Kurose. “I see others following that lead.”

— With assistance by Kurt Schussler

No comments:

Post a Comment