U.S. markets closed

S&P 500

2,386.13-324.89(-11.98%)Dow 30

20,188.52-2,997.10(-12.93%)Nasdaq

6,904.59-970.28(-12.32%)Russell 2000

1,037.42-172.72(-14.27%)

Motley Fool Issues Rare "Double Down" Buy Alert

This Stock Was Issued A Rare Double Down Buy Alert By Our Experts. 1 Stock The World's Best Investors Are Buying Now. Access Our Report Today. BusinessYahoo Finance•4 hours ago

BusinessYahoo Finance•4 hours agoThe Dow just crashed 3,000 points — here is why it happened

Here is how President Trump just rocked the stock market. BusinessMarketWatch•4 hours ago

BusinessMarketWatch•4 hours agoStocks aren’t bargains yet, but a buying opportunity will come. Here’s how you’ll know it’s here

Four key ratios show the U.S. market’s valuation picture is a lot better than it was a month ago, writes Mark Hulbert. BusinessMarketWatch•9 hours ago

BusinessMarketWatch•9 hours agoWarren Buffett’s latest advice could help you retire much richer

Warren Buffett, the iconic billionaire investor and chairman of Berkshire Hathaway (BRK)(BRK) recently released his latest letter to shareholders. For instance, he spends a fair amount of his space in this year’s letter talking about company directors and how to hire them. Now, this is not something investors think much about. BusinessYahoo Money•4 hours ago

BusinessYahoo Money•4 hours agoThis is why you can’t get that historically low mortgage rate

As homeowners rush to lock in record low mortgage rates by refinancing, a strange thing is happening: They can’t get those rates.

$10 Stock You Should Buy Today

Wall Street Legend Paul Mampilly shows you the top stock of 2020… and it's only $10! See the details here… BusinessInvestor's Business Daily•3 hours ago

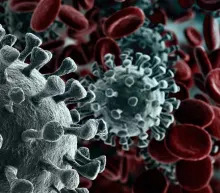

BusinessInvestor's Business Daily•3 hours agoModerna Rockets After Dosing First Patient In Coronavirus Vaccine Test

Shares of Moderna stock rocketed Monday after the biotech announced it had dosed the first patient in a study of its coronavirus vaccine. The company is already planning a Phase 2 study. BusinessUSA TODAY•7 hours ago

BusinessUSA TODAY•7 hours agoWhat zero rates, sub-1% bond yields mean for your mortgages, student loans and credit cards

There’s good news on the horizon for Americans: bond yields have dropped to historic lows, trimming borrowing costs on mortgages and student loans. BusinessInvestor's Business Daily•28 minutes ago

BusinessInvestor's Business Daily•28 minutes agoDow Jones Futures: Coronavirus Stock Market Crash Accelerates As San Francisco Goes On Lockdown; Tesla Fremont Plant To Close? Amazon Hiring

Futures rose as the coronavirus stock market crash intensified on a San Francisco lockdown. Tesla's main plant is at risk. But Amazon is hiring. BusinessTipRanks•yesterday

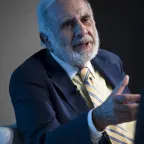

BusinessTipRanks•yesterdayBillionaire Carl Icahn Picks up These 2 Stocks on the Dip

Rounding out an exceptionally volatile week of trading, the market delivered another dramatic swing, this time finishing in the green. After March 12 saw both the S&P 500 and the Dow Jones indexes post their largest single-day percentage losses since the October 1987 crash, stocks rallied the next day, with the S&P 500 jumping over 9%. This gain, which represents its best session since 2008, came as a result of President Trump’s declaration that his administration will do whatever is necessary to mitigate the coronavirus’ impact on the economy. Against this backdrop, billionaire investor Carl Icahn offered up his take on the market’s sell-off. The Wall Street heavyweight graduated from Princeton with a Philosophy degree, and went on to found publicly traded holding company Icahn Enterprises. With a current net worth of $15.2 billion, the guru is known as one of the most successful stock pickers on the Street, and thus captured investor attention with his most recent statements. While noting that stocks still haven’t hit bottom yet, Icahn argues that the recent market weakness presents investors with unique buying opportunities. “Now it’s reached a point that there are some companies that are sort of just given away. Some of these companies are awfully cheap, they’re very cheap,” he commented. Setting out on our own stock search, we decided to take a page from the billionaire’s playbook. We looked at two names Icahn snapped up recently, and after running them through TipRanks’ Stock Screener, found out that each boasts serious upside potential. Here are the details. Hertz Global Holdings Inc. (HTZ) Hertz Global is the holding company behind the Hertz car rental service, one of the top players in the space. So far in 2020, shares have plunged 48%, but that doesn’t mean it’s time to count this name out just yet. Based on his recent purchase of over 11.4 million shares, this appears to be the opinion of Icahn. From March 10-March 12, he spent $7.43 per share, on average, to boost his HTZ position. With the total holding now coming in at 55,342,109 shares, Icahn owns a 38.9% stake. Turning now to the analyst community, while the company reported an EBITDA miss for the fourth quarter, Jeffries’ Hamzah Mazari argues that the print wasn’t all bad. Thanks to “higher than expected vehicle depreciation expense which Avis (CAR) did not experience”, EBITDA missed the Street’s $68 million call by 21%, with the figure only reaching $54 million. That being said, Mazari points out that SG&A and U.S. RAC pricing was better than expected. “Having said that, Q4 pricing came in 4%-plus in U.S. RAC which is the strongest seen in 8-plus years. We think HTZ focus on pricing will be a main driver in 2020 as management is not willing to sacrifice on price for volume. We note this is a different strategy from that of CAR as they go after longer length of rental (sacrifice some on the pricing side),” the analyst stated. It should be noted that some investors have expressed concern related to vehicle costs as increased recall activity and the roll off of depreciation benefits as 2018 models were sold caused deprecation per unit to grow 11%. However, Mazari doesn’t expect this to hamper the company going forward as fleet management improves and residuals decline to low single digits. Margins are also slated for a boost as a result of productivity initiatives, according to Mazari. However, the analyst thinks that HTZ still has work to do in terms of its transition in addition to its high balance sheet leverage and low visibility into the timing of investment spend fall off. This prompted Mazari to reiterate a Hold call and a $17 price target. Nonetheless, this target conveys his belief that shares could soar 106% in the next twelve months. (To watch Mazari’s track record, click here) What does the rest of the Street think about HTZ? Looking at the consensus breakdown, 2 Buys and 1 Hold issued in the last three months add up to a Moderate Buy. At $17.67, the average price target brings the upside potential to 114%. (See Hertz stock analysis on TipRanks) Newell Brands Inc. (NWL) Over the last century, Newell Brands has made a name for itself as one of the top consumer goods companies. Its well-known brands include the likes of Sharpie, Coleman, Rubbermaid and Crock Pot, just to name a few. Despite falling 34% in the last month, some Wall Street pros think investors should take advantage of the opportunity presented by the recent weakness. Carl Icahn falls into this category. Between March 9-March 11, the billionaire pulled the trigger on 2,585,201 NWL shares, making him a 10.7% owner of the company. At an average price of $13.41 per share, the total purchase value comes in at about $34.7 million. Meanwhile, after CEO Ravi Saligram’s presentation at the CAGNY conference in Florida, SunTrust Robinson analyst Bill Chappell walked away more confident in the company’s long-term prospects. NWL has struggled following the loss of a large number of highly qualified managers between 2017 and mid-2019 which led to lower moral among employees. That being said, Chappell sees NWL’s appointment of a new head of the Outdoor & Rec segment and its three new senior hires as steps in the right direction. “Past management teams have erred in trying to centrally operate the business vs. relying on managers who fully understood the intricacies of their particular business. These new hires, along with others expected in the coming months, give us greater confidence that NWL can at least maintain category growth over the next few years,” Chappell explained. On top of this, management stated that in the long run, it will place a significant focus on achieving LSD core sales growth, 50 basis points of annual operating margin improvement and 100%-plus free cash flow (FCF) conversion. According to Chappell, should the company meet its FCF goal, it would imply that its 108% FCF conversion in 2019 wasn’t a one-time victory. He added, “Also, we believe this implies that the company, often thought of as a ‘serial restructurer’, is now finally done with major restructuring. As the FCF opportunity is better understood by the Street, we believe the stock’s multiple will expand.” Even though growth in NWL’s Outdoor & Rec and Appliances & Cookware businesses isn’t expected for at least a year, Chappell points out that they only account for about 10% of profits. It also doesn’t hurt that the dividend yield lands at more than 8%. Based on all of the above, Chappell stayed with the bulls. In addition to reiterating his Buy recommendation, the five-star analyst left the $25 price target as is, implying 93% upside potential. (To watch Chappell’s track record, click here) Out on the Street, other analysts are less bullish on NWL. A Hold consensus rating breaks down into 1 Buy and 4 Holds. While less aggressive than Chappell’s forecast, the $21.50 average price target still leaves room for a possible 66% twelve-month gain. (See Newell Brands price targets and analyst ratings on TipRanks)

27 Best Car Movies Of All Time, Ranked

If you've seen the best car movies and you're ready for more, here's a fresh batch of films that will keep you entertained. BusinessMarketWatch•yesterday

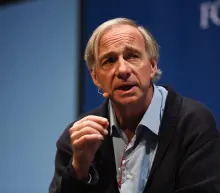

BusinessMarketWatch•yesterdayBillionaire Ray Dalio says world’s largest hedge fund ‘didn’t know how to navigate’ coronavirus stock-market selloff and should have ‘cut all risk’ but failed to react

Ray Dalio’s deft navigation of the financial crisis 12 years ago helped to burnish his image — and bankroll — as a legendary investor. But the current coronavirus crisis has caught the star investor off guard. BusinessFox Business•12 hours ago

BusinessFox Business•12 hours agoHow low coronavirus-led stock market selloff could go: Goldman Sachs

Goldman Sachs says the S&P; 500 could plunge to about 2,000 in a worst-case scenario due to the coronavirus outbreak.

My Portfolio & Markets

Customize

Your list is empty.

Sign-in to view your list and add symbols.

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| BTC-USD

Bitcoin USD

| 4,990.21 | -27.03 | -0.54% |

| ETH-USD

Ethereum USD

| 110.75 | -0.43 | -0.39% |

| XRP-USD

XRP USD

| 0.1420 | +0.0003 | +0.2038% |

| USDT-USD

Tether USD

| 1.0027 | +0.0052 | +0.5187% |

| BCH-USD

Bitcoin Cash USD

| 171.09 | -0.47 | -0.27% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| MRNA

Moderna, Inc.

| 26.49 | +5.19 | +24.37% |

| OPGN

OpGen, Inc.

| 4.0400 | +2.0300 | +101.00% |

| BNTX

BioNTech SE

| 40.00 | +9.07 | +29.32% |

| APRN

Blue Apron Holdings, Inc.

| 3.8200 | +1.5400 | +67.54% |

| ZM

Zoom Video Communications, Inc.

| 107.86 | +0.39 | +0.36% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| BAC

Bank of America Corporation

| 20.44 | -3.72 | -15.40% |

| GE

General Electric Company

| 6.66 | -1.19 | -15.16% |

| F

Ford Motor Company

| 5.01 | -0.62 | -11.01% |

| MSFT

Microsoft Corporation

| 135.42 | -23.41 | -14.74% |

| AAL

American Airlines Group Inc.

| 15.92 | +1.61 | +11.25% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| NMHLY

NMC Health Plc

| 3.5000 | +1.5000 | +75.00% |

| BNTX

BioNTech SE

| 40.00 | +9.07 | +29.32% |

| GFI

Gold Fields Limited

| 5.16 | +1.09 | +26.78% |

| MRNA

Moderna, Inc.

| 26.49 | +5.19 | +24.37% |

| AU

AngloGold Ashanti Limited

| 17.46 | +3.29 | +23.22% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| GLPI

Gaming and Leisure Properties, Inc.

| 19.55 | -13.64 | -41.10% |

| STKAF

Stockland

| 2.1650 | -1.4750 | -40.52% |

| SRC

Spirit Realty Capital, Inc.

| 25.09 | -13.59 | -35.13% |

| GOFPY

Greek Organization of Football Prognostics S.A.

| 2.9370 | -1.5720 | -34.86% |

| TUIFY

TUI AG

| 1.6200 | -0.8400 | -34.15% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| USSPX

USAA 500 Index Fund Member Shares

| 32.81 | -4.49 | -12.04% |

| MASTX

BMO Large-Cap Growth Fund Class Y

| 14.14 | -1.87 | -11.68% |

| MLCIX

BMO Large-Cap Growth Fund Class I

| 14.28 | -1.89 | -11.69% |

| BLGRX

BMO Large-Cap Growth Fund Class R6

| 14.31 | -1.89 | -11.67% |

| BALGX

BMO Large-Cap Growth Fund Class A

| 14.12 | -1.87 | -11.69% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| GOEX

Global X Gold Explorers ETF

| 16.66 | +2.23 | +15.46% |

| RING

iShares MSCI Global Gold Miners ETF

| 18.20 | +1.40 | +8.33% |

| ZROZ

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund

| 172.76 | +13.37 | +8.39% |

| EXT

WisdomTree U.S. Total Earnings Fund

| 28.83 | +2.05 | +7.64% |

| TLT

iShares 20+ Year Treasury Bond ETF

| 163.91 | +9.97 | +6.48% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| BTCUSD=X

BTC/USD

| 4,990.2119 | -27.0283 | -0.5387% |

| ETHUSD=X

ETH/USD

| 110.7512 | -0.4336 | -0.3899% |

| EURUSD=X

EUR/USD

| 1.1162 | -0.0018 | -0.1574% |

| JPY=X

USD/JPY

| 106.2360 | +0.3660 | +0.3457% |

| GBPUSD=X

GBP/USD

| 1.2262 | +0.0001 | +0.0106% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| ES=F

E-Mini S&P 500 Mar 20

| 2,426.00 | +9.75 | +0.40% |

| YM=F

Mini Dow Jones Indus.-$5 Mar 20

| 20,535.00 | +136.00 | +0.67% |

| NQ=F

Nasdaq 100 Mar 20

| 7,126.50 | +69.00 | +0.98% |

| RTY=F

E-mini Russell 2000 Index Futur

| 1,040.00 | +7.60 | +0.74% |

| ZB=F

U.S. Treasury Bond Futures,Jun-

| 180.47 | -0.59 | -0.33% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| HYG200320P00085000

HYG Mar 2020 85.000 put

| 9.23 | +3.98 | +75.81% |

| CHNG200320C00022500

CHNGV Mar 2020 22.500 call

| 0.0500 | 0.0000 | 0.00% |

| CHNG200320P00022500

CHNGV Mar 2020 22.500 put

| 13.55 | 0.00 | 0.00% |

| F210115C00010000

F Jan 2021 10.000 call

| 0.1300 | +0.0300 | +30.00% |

| HYG200320P00082000

HYG Mar 2020 82.000 put

| 6.00 | +3.50 | +140.00% |

| Symbol | Last Price | Change | % Change |

|---|---|---|---|

| ZIOP200320C00001000

ZIOP Mar 2020 1.000 call

| 2.0500 | 0.0000 | 0.00% |

| ZIOP200320C00001500

ZIOP Mar 2020 1.500 call

| 1.6000 | 0.0000 | 0.00% |

| ZIOP200320C00002000

ZIOP Mar 2020 2.000 call

| 0.1500 | -0.0500 | -25.00% |

| ZIOP200417C00003000

ZIOP Apr 2020 3.000 call

| 0.2600 | 0.0000 | 0.00% |

| ZIOP200417C00002000

ZIOP Apr 2020 2.000 call

| 0.7000 | 0.0000 | 0.00% |

Rates

© 2020 Verizon Media. All rights reserved.

No comments:

Post a Comment