The recovery is far from complete, and the US economy remains of danger of shifting into reverse once again. One major risk factor: A rise in Covid-19 infections,

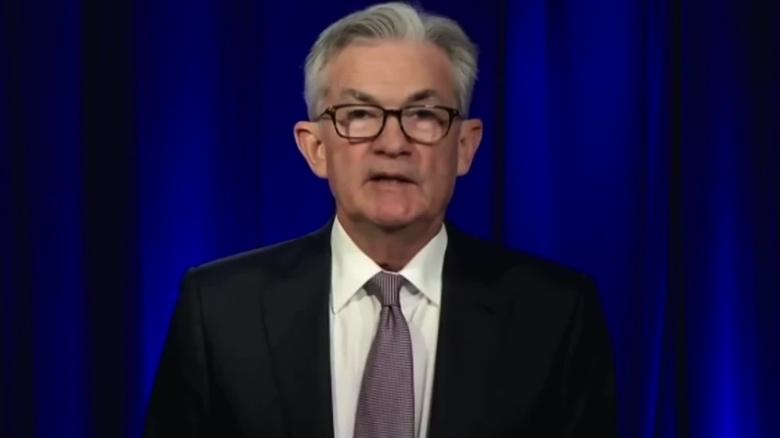

Federal Reserve Chairman Jerome Powell said Tuesday at the National Association for Business Economics annual meeting.

A second wave of coronavirus could "more significantly limit economic activity, not to mention the tragic effects on lives and well-being," Powell said. "Managing this risk as the expansion continues will require following medical experts' guidance, including using masks and social-distancing measures."

In addition to gaining control of the pandemic, Powell reiterated his calls for more fiscal stimulus aimed at supporting America's most vulnerable.

That's a heavily debated subject on Capitol Hill at the moment. Although Democrats widely support another huge influx of government spending to shore up the economy -- the House passed a

$2.2 trillion version of that last week -- Republicans have been united in opposition, arguing such a plan would be too costly.

Stimulus negotiations have been in gridlock for months.

Yet Powell said Tuesday that the risks of Congress pouring too much stimulus into the economy are far lower than the risk of not doing enough. Although government spending is adding to an already sky-high federal budget, lawmakers should act, Powell argued.

"The US federal budget is on an unsustainable path, has been for some time," Powell said. But "this is not the time to give priority to those concerns."

The Federal Reserve slashed interest rates to near zero in March and has rolled out various loan facilities to support different parts of the economy since then. A survey of the central bank's officials last month showed the policymakers

don't expect to raise rates again until at least 2023.

But sugar rush from Congress' stimulus packages in the spring and the Fed's fiscal policy has been wearing off. The pace of the economic recovery has slowed. For example, after adding more than a million jobs every month between May and August,

last week's September jobs reported showed only 661,000 jobs were added back to the economy, fewer than expected.

CNN Business'

Economic Recovery Dashboard shows the US economy is only 80% as strong as it was before the pandemic. In other words, it's got a long road back.

A prolonged slowing of the recovery is bad news, Powell said, "as weakness feeds on weakness."

The Fed chairman also stressed once again that the burdens of the crisis haven't been evenly distributed and that women, minorities and low-income workers are in a

much worse position in this downturn than others.

Unemployment and bankruptcies will always be part of the economy, he acknowledged. But having an "inappropriate" amount of either is bad for the longer term outlook. For example, the number of permanent layoffs has been rising after a large number of workers were initially classified has having temporarily lost their jobs.

"Once you're permanently laid off it's just difficult to get back into the workforce," Powell said.

No comments:

Post a Comment