begin quote from:

Trump Riles Asian Trade Partners With Tariffs on Solar, Washers

Bloomberg News

Updated on

From

-

China says tariffs will worsen global trading environment

-

Some manufacturers say actual tariffs could have been worse

BlackRock’s Philipp Hildebrand says the "biggest risk" to the economy is trade issues.

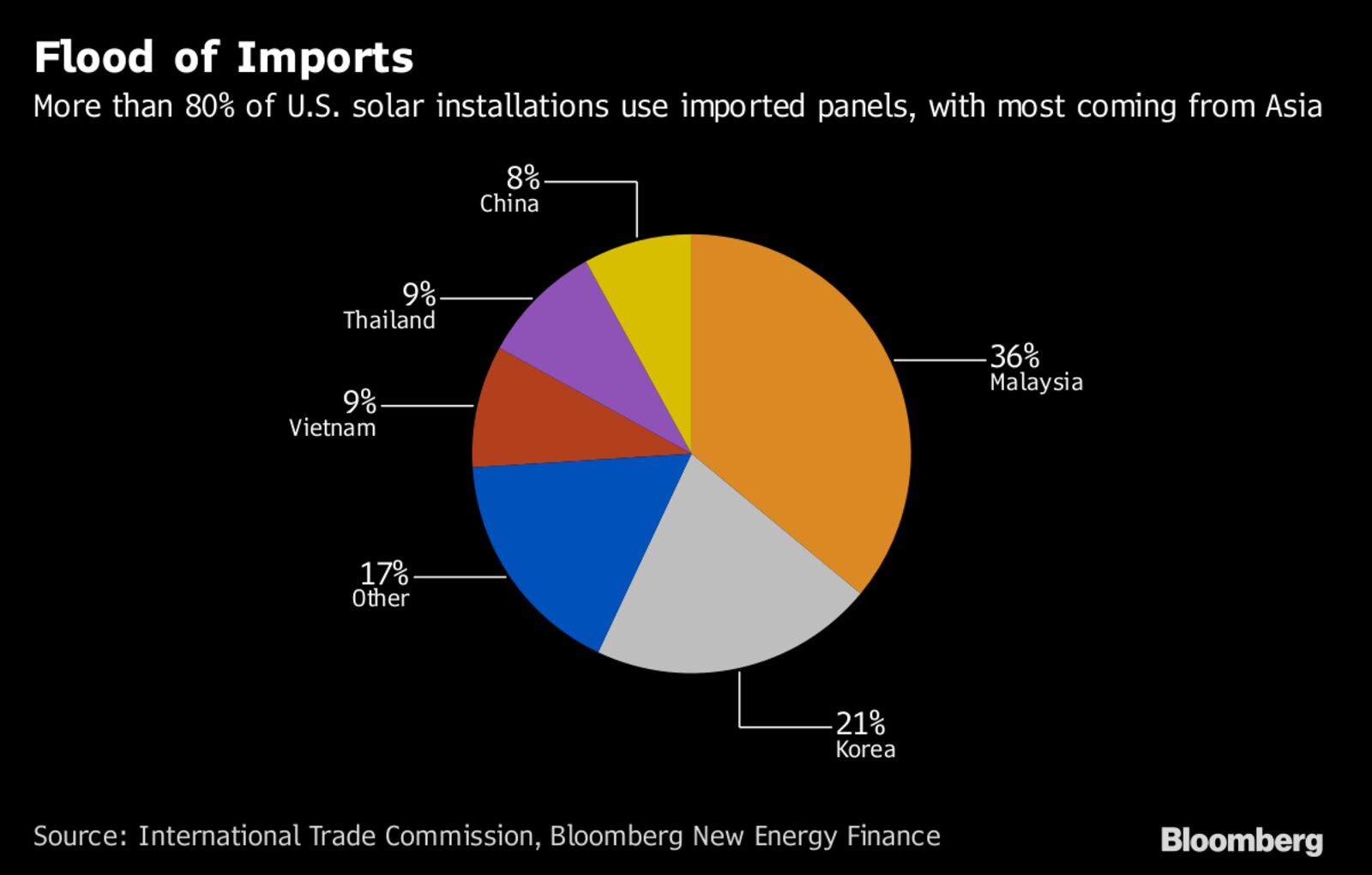

The U.S. will impose new duties of as much as 30 percent on foreign-made solar equipment, the U.S. Trade Representative’s office said Monday. The president also approved tariffs starting as high as 50 percent on imported washing machines. Chinese and South Korean officials condemned the move, analysts said it could backfire, while markets largely shrugged it off.

The tariffs were announced as Trump prepares to travel to the World Economic Forum in Davos, Switzerland, where the international business and political elite gather to mull the current state of the global order. While the measures may sharpen the president’s “America First” policy after months of rhetoric and herald a hotter trade conflict with China, in Asia manufacturers and investors said the reality wasn’t as bad as they had feared.

Investors "are used to bluff from Trump, which often turns out to be a non-event,” said Qiu Zhicheng, a strategist at ICBC International Research Ltd. in Hong Kong. "As long as the situation doesn’t escalate into a full-scale trade war, the market impact will be limited. We believe the two economies will stay rational, as a trade war would hurt both."

South Korea’s trade minister said Tuesday that his nation will file a petition with the World Trade Organization against the U.S. for imposing anti-dumping duties on Korean washing machine and solar panel makers. The U.S. decision is “excessive,” Kim Hyun-chong said.

China exported more than 21 million washing machines worth just under 19 billion yuan ($2.9 billion) globally from January through November 2017, according to customs data. China is also the world’s largest exporter of solar panels.

What Our Economists Say..."Coming ahead of Trump’s Davos trip, the solar and washing machine tariffs are striking, but still fall into the narrow category," said Tom Orlik, Bloomberg Economics chief Asia economist in Beijing. "The big question on U.S. tariffs heading into 2018 is if new measures will be narrow and bad news just for targeted sectors or broad and risk tipping over into a drag on overall growth." |

Chinese solar manufacturers have already been figuring out how to deal with the worsened trade outlook with the U.S. since the U.S. International Trade Commission ruled that the influx of cheaper foreign panels was hurting domestic producers in September.

The president approved four years of tariffs that start at 30 percent in the first year and gradually drop to 15 percent. The first 2.5 gigawatts of imported solar cells will be exempt from the tariffs, USTR said in a statement Monday. The solar tariffs are lower than the 35 percent the ITC recommended in October. The body was responding to a complaint by Suniva Inc., a bankrupt U.S. panel maker that sought duties on solar cells and panels.

The outcome is "better than expected," according to a statement by JinkoSolar, China’s biggest panel maker on Tuesday.

Trade Action

More U.S. trade action could be on the way, as several key files remain on the president’s desk. He has about three months to decide whether to impose tariffs on imported steel and aluminum, while his top trade official is probing China’s intellectual-property practices. Negotiators from the U.S., Canada and Mexico are meeting this week in Montreal for the latest round of negotiations on a revised North American Free Trade Agreement.China is already facing stiff tariff opposition in Europe. The European Union imposed tariffs on imports of Chinese solar panels in December 2013 and extended them for 18 months in March last year. They are among billions of euros of levies imposed on Chinese exports of goods including reinforcing steel, aluminum foil, bicycles, screws, paper, kitchenware and ironing boards.

In the washing-machine case, Trump was responding to an ITC recommendation in November of tariffs following a complaint by Whirlpool Corp., which accused Samsung Electronics and LG Electronics Inc. of selling washing machines in the U.S. below fair-market value.

Trump opted for the most punitive recommendation by ITC judges for residential washers. He ordered a 20 percent tariff on imports under 1.2 million units, and 50 percent on all subsequent imports in the first year, with duties lowering in the next two years.

LG Electronics, Samsung and other washing-machine makers have options to mute the impact of the new levy. Manufacturers can re-route production to countries exempt from the new taxes. Samsung and China’s Qingdao Haier Co. also have U.S. factories that could ramp up production and help ease the trade conflict.

“The overall impact on Asean will be that Americans will now think twice before they buy these products, so demand will probably slow,” said Eduardo Araral, a political economist at the Lee Kuan Yew School of Public Policy in Singapore. "U.S. consumers will lose out. Workers will be protected, but then workers are also consumers and they will just end up paying more and the U.S. will just naturally lose out from these protectionist measures.”

— With assistance by Andrew Mayeda, Ari Natter, Yinan Zhao, Kevin Hamlin, Sam Kim, Ting Shi, David Tweed, Brian Eckhouse, and Sarah McGregor

No comments:

Post a Comment