Worried About Negative Interest Rates Coming? They Are Already Here, And That Is A Serious Problem

WASHINGTON, DC - JANUARY 10: Federal Reserve Board Chairman Jerome Powell speaks at the Economic Club of Washington January 10, 2019 in Washington, DC. Powell answered a range of questions related to the U.S. economy during a question and answer

GETTY IMAGES

We read about Europe’s negative interest rates, and they seem nonsensical. Savers paying banks to keep their cash. Mortgage lenders paying homeowners to borrow.

In the U.S., 0% has been the downside limit. Much more sensible, right? Well, no, because that 0% did not cover inflation – the loss of purchasing power that averaged 2.0% over the past decade. And that means…

We’ve been contending with negative real rates for over ten years.

While we have continually heard about inflation being “too low,” it still amounted to a large depreciation over the past ten years – fully 21.5% (an annual average of 2.0%).

How did this happen?

This use of a 0% nominal interest rate came about because Fed Chair Ben Bernanke ignored former Fed Chair Alan Greenspan’s low-rate lesson: a 0% real rate should be the lowest level set by the Federal Reserve. Anything lower is comparable to a wealth tax – the extraction and depletion of capital through the depreciation of the dollar.

So, Greenspan’s 0% minimum was the point where savers earn a rate that equals the inflation rate, thus maintaining the real purchasing power of their cash. Therefore, any rate less than the inflation rate should be viewed as a negative real rate.

Today In: Money

Get ready to be upset

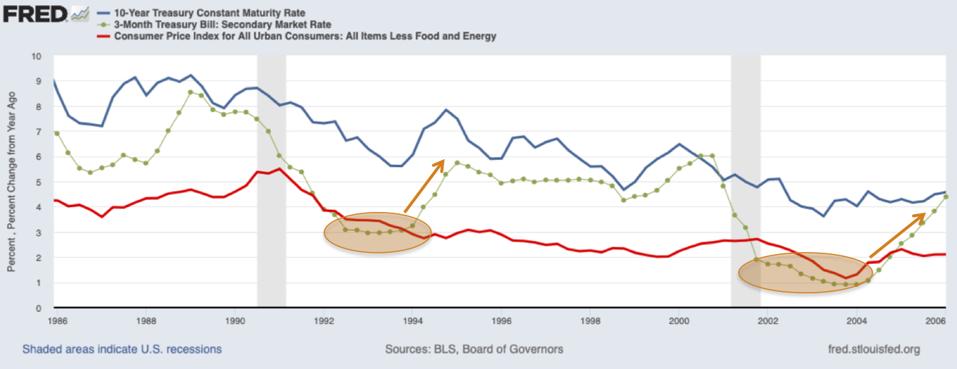

First, look at the Greenspan era

YOU MAY ALSO LIKE

Alan Greenspan had five terms as Chair of the Federal Reserve, serving under four presidents (August 11, 1987 through January 31, 2006). He had to contend with three downside challenges: the 1987 crash, the 1990-91 financial/banking recession and the 2000-2002 post-internet bubble recession.

The first, 1987, was a liquidity crisis that was handled relatively quickly. It did not have lasting effects and was over fairly quickly.

For the two recessions, Greenspan chose to manage interest rates, not only during the recession, but also afterwards.

The graph below shows the record. The key item to note is that he dropped the short-term interest rate only to the level of the inflation rate – a real 0% level.

Rates and inflation during Alan Greenspan years

JOHN TOBEY (FEDERAL RESERVE BANK OF ST LOUIS - FRED)

Note that when Greenspan decided to let rates rise back to normal, where investors earned a real return, he did so methodically - without hesitations, pauses or reversals.

The good lesson is that Greenspan’s rate management properly focused on real (inflation-adjusted) interest rates.

The bad lesson is that he showed that the Federal Reserve could get away with overriding the capital markets for a long time, well beyond the recession-caused dysfunctional period.

Now, look at the Bernanke/Yellen/Powell era, so far

Fed Chair Ben Bernanke, citing serious problems, dropped short-term interest rates down to a nominal 0% at year-end 2008. That had not been done since World War II, when the government had to rely on patriotism to help fund the war effort.

Virtually no one thought that this was the beginning of a lengthy period of maintaining the near-0% rate. Over the months and years, Bernanke would argue that, yes, things had improved, but they were not good enough yet to allow short-term rates to rise.

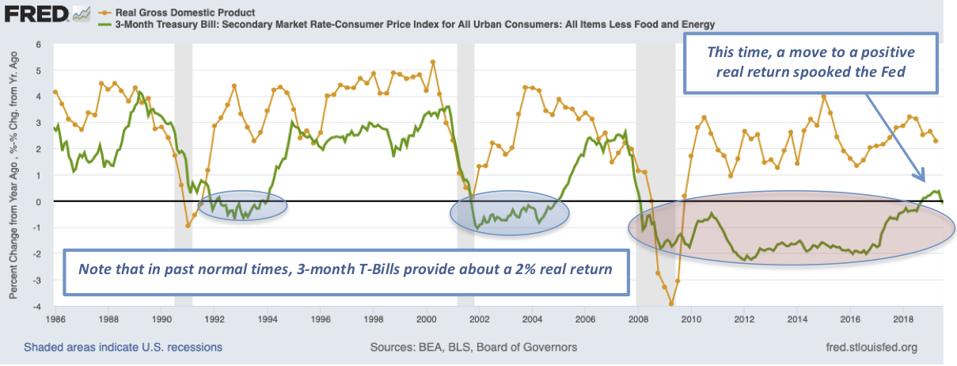

Perhaps the most disingenuous argument he made was that economic growth was too low. Why disingenuous? Because he used the real (inflation-adjusted) growth rate at the same time he argued for the 0% nominal (non-inflation adjusted) interest rate. He was trapped on the one side because real GDP growth is the standard measure used everywhere. No one wants to count inflation gains as growth. Now, what to say about the 0% interest rate. Instead of explaining the reality, he chose to say nothing, likely believing (correctly) that few would figure out the mismatch he presented. Had he fessed up, this is what people would have seen:

Real GDP growth and interest rates

JOHN TOBEY (FEDERAL RESERVE BANK OF ST LOUIS - FRED)

Month-after-month, year-after-year, Bernanke maintained this mantra. Following him, Fed Chairs Janet Yellen and Jerome Powell took only tepid steps to get rates back to “normal” (or “neutral” as Powell mislabels it). Both timidly bent to the temporary market reactions to rising rates, misinterpreted as “tightening” by those who had grown accustomed to the lengthy, abnormally low rate environment.

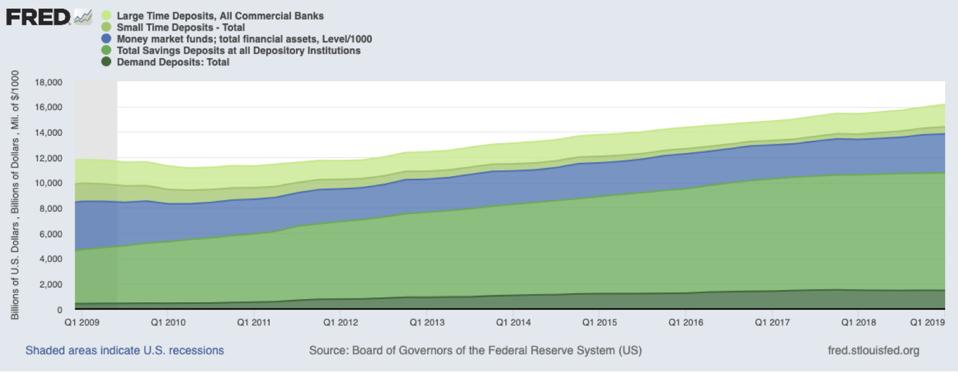

To show the damage from the last decade (July 2009 to July 2019), look at the cumulative results:

- 3-month U.S. Treasury Bill yield: 5.1% cumulative (0.5% annual average)

- CPI inflation rate: 21.5% cumulative (2.0% annual average)

So, a $100,000 investment in July 2009 would have grown to $105,076 by July 2019. However, $1.00 in July 2019 dollars is worth only $0.823 in July 2009 dollars. That means the current $105,076 investment is worth only $86,480 in 2009 dollars, a purchasing power loss of $13,520.

This large loss was not limited to savers. It has adversely affected all investors, funds, trusts, companies, non-profit organizations and even state and local governments. Moreover, as has been widely discussed, it has led many who need income to take on added risk in order to try to produce income.

How much money are we talking about? An average of about $14 trillion over the past decade – and that doesn’t include all the direct ownership of short-term securities like U.S. Treasury bills. The loss on $14 trillion? Easily calculated: $14T times -15% = $2.1T. And remember – that amount is only the loss of purchasing power. If short-term rates had been normal (i.e., above the inflation rate), there would have been an additional, huge amount of interest income received.

Short-term assets held during past ten years

REAL GDP GROWTH AND INTEREST RATES

The fallout beyond the negative real rate

The short-term rate is the foundation stone for the financial system structure. Cause it to be abnormally low for an extended period and repercussions occur throughout the financial system.

Worst of all, it alters the thinking and beliefs of many (most?) investors and even younger investment professionals. A few years ago, I asked the head of a major bond firm how he kept his newer bond analysts and managers educated about normal markets. He said it was his greatest concern – that all those fresh, new MBAs had no idea how the bond markets actually work and where the risks hide.

The bottom line

We have been in a negative rate environment for a decade. The problem is, messing about with the capital markets, especially the keystone activity of rate-setting, can only muck up the system. It causes capital to flow “improperly” and it under- or over-rewards participants (savers, investors and all the others).

And yet – It looks like we’re going to experience the sequel, after never getting near that normal 2% real return for short-term securities. Jerome Powell has started reducing the still abnormally low rates further. His rationale? Unspoken, it is to placate Wall Street – remember the talk about the “too much, too soon” rate increases? Instead, he rolls out the Bernanke excuse: “Things look okay, but they are not good enough because there is risk of slower growth.”

There is no dodging what is in store

We should not expect any good to come out of this low rate sequel. A Fed-controlled rate of 0% or negative may be effective when the financial system is in disarray, but it has never (let me restate that: NEVER!) been attempted either to boost slow growth or prevent a recession.

One ugly, possible outcome is that 0% nominal rates are found ineffective, and the frustration (desperation) allows the Fed to push rates into negative nominal territory.

We are so far down the road, it is hard to see how the erroneous thinking and beliefs can be corrected. To start with, it would take at least the Fed, heads of financial companies and the media to take seriously the damage done to all those holding the trillions of short-term assets. Then, they would need to re-adopt what was once a given: faith and confidence in capitalism, where capital is allocated through the freely operating capital markets.

No comments:

Post a Comment