begin quote from:

RIP jeans. We're all eating our feelings now

By Allison Morrow, CNN Business

Updated 2:35 PM ET, Thu August 13, 2020

00:05/02:57

(CNN Business)A version of this article first appeared in CNN Business' new Nightcap newsletter. Sign up here for all the business news you missed while you were busy doing other stuff all day.

Every now and then we find a consumer trend that really tells us something about the state of the world. And lately, that trend is snacks. Snacks that our dentists or nutritionists might shame us about. (But honestly, take a look at the headlines on any given day in 2020 and then tell me not to finish that pint of Super Fudge Chunk.)

We the people are snacking in direct proportion to our collective angst. Take a look:

- There's a run on Dr. Pepper right now, even though consumer tastes have been shifting away from sugary sodas in recent years.

- It's only August and already Halloween candy is EVERYWHERE.

- Beer sales are picking up.

- Ice cream made with liquor is now legal in New York, because sure, why not.

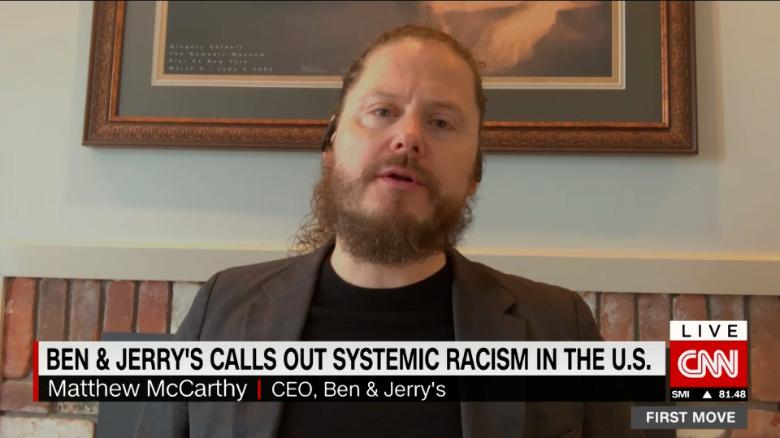

- Ben and Jerry have become the voices of moral authority.

Oh yeah, also: Gyms remain closed in many places and stretchy leggings are officially business attire.

So be kind to yourselves, readers. We're all in this together.

SPLIT TAKE

Like so many '90s trends, stock splits are cool again. Tesla just announced a so-called 5-for-1 stock split, following a similar move by Apple. Let's unpack that for a moment.

What's a stock split?

Pretty much like it sounds: A split divides up shares into smaller increments. If you owned 10 shares of Tesla before, you'll soon own 50, but the price per share goes down, and the overall value stays the same.

Why split?

As Wall Street enthusiasm pushes shares higher, they become less attainable for everyday investors. Think of the hordes of Robinhood users who are often new to investing and tend to load up on cheaper securities.

Just look at Tesla and Apple. Tesla's stock is on a roll this year. Shares have risen more than 200% since January, to about $1,500. Apple is up more than 45% this year, to about $450 a share. Not exactly cheap.

Amazon (AMZN) and other big tech companies have resisted splits for years, perhaps inspired by the OG anti-split guru, Warren Buffett. The Oracle of Omaha's Berkshire Hathaway Class A shares are trading well over $300,000. (But even Berkshire offers more affordable B shares for individual investors, at $215 a pop.)

Why the reluctance?

Well, it's Wall Street, so there's a fair bit of ego involved. And since splits are mostly cosmetic, there's not a ton of incentive to buck the trend.

A $1,400 NON-IPHONE?

Microsoft's about to roll out its first Android phone. And it's ... insanely expensive.

The Surface Duo will cost $1,400. That's about the same price as a tricked out iPhone 11 Max. Or a single share of Tesla.

But the price makes sense for a few reasons:

- First, it's a dual-screen device. Essentially a folding tablet.

- Second, Microsoft is probably counting on the Duo to be a showcase piece. It's more about what's possible rather than convincing millions of customers to abandon their iPhones.

QUOTE OF THE DAY

"The hair choices of Black women can be very consequential. Hair is not just hair."

A Duke University study found that Black women with natural hairstyles, including curly afros, twists or braids, are less likely to get job interviews than women with straightened hair.

WHAT ELSE IS GOING ON?

- Meat prices are finally falling — except for hot dogs. Food prices overall fell a seasonally adjusted 0.4% in July, the first decrease since April of last year.

- The UK economy shrank by more than 20% in the second quarter, the worst slump on record and the biggest drop of any major global economy.

- Discount retailer Stein Mart became the latest chain to file for bankruptcy. It plans to close most of its nearly 300 stores.

![[Gallery] The World's Most Beautiful Cities You Have To See [Gallery] The World's Most Beautiful Cities You Have To See](https://images.outbrainimg.com/transform/v3/eyJpdSI6ImM5ZWZmZDUyOGI2ZTJhZWI5ZDlmNDkzOTAzMjAxY2FkZWIzZGM5YWI3NTk5YmI3M2U4ZDI4MDYyMDk4ZjhjNGEiLCJ3Ijo4MDAsImgiOjUwMCwiZCI6MS4wLCJjcyI6MCwiZiI6NH0.webp)

No comments:

Post a Comment