However, here they are since 1950:

Here Comes The Most Bullish Five Days Of The Year ...

finance.yahoo.com/.../photoset-heres-comes-the-most-bu...

1 day ago - Here Comes The Most Bullish Five Days Of The Year. Going back to 1950, there isn't any day better than October 27 to buy (the close) on the ...

Yahoo! Finance

Sun, Oct 26, 2014, 2:54AM EDT - US Markets are closed

Here Comes The Most Bullish Five Days Of The Year

14 hours ago

Here Comes The Most Bullish Five Days Of The Year

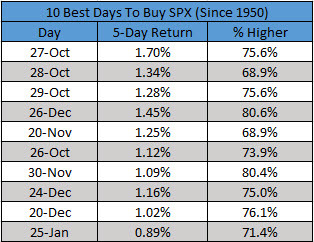

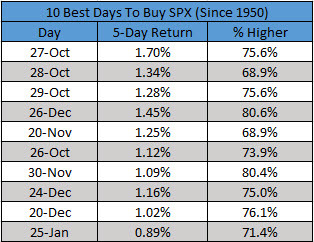

Going back to 1950, there isn’t any day better than October 27 to buy (the close) on the S&P 500 (SPX) and hold for the next five trading days. Here are the top 10 days to buy.

Since

October 27 is this Monday, history would say even though we had a big

bounce last week, there’s a good chance the strength can continue.

Since

October 27 is this Monday, history would say even though we had a big

bounce last week, there’s a good chance the strength can continue.

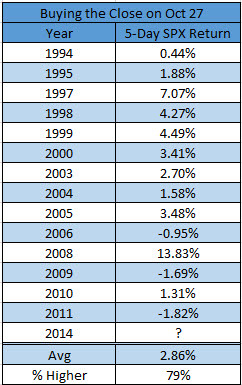

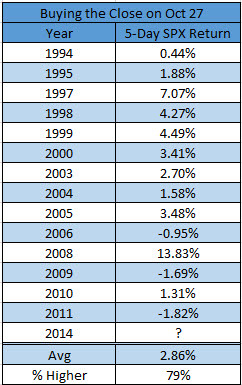

'14 is the first time we've had an October 27 on a weekday in three years. Here are the returns over the past 20 years. Once again, overall very strong returns.

Thanks to James Smith for the photo.

Going back to 1950, there isn’t any day better than October 27 to buy (the close) on the S&P 500 (SPX) and hold for the next five trading days. Here are the top 10 days to buy.

'14 is the first time we've had an October 27 on a weekday in three years. Here are the returns over the past 20 years. Once again, overall very strong returns.

Is this a foolproof way to trade? Absolutely not. In fact, last week was the 42 week of the year and I noted how historically it was one of the worst weeks to be long.

Well, that sure didn’t work in ‘14, as the SPX had its best week of

the year and biggest weekly gain since late December ‘12.

Lastly,

I’d like to note that my birthday is October 28 and my Mom’s birthday

is November 2. Pretty much right in the heart of these five days. This

is significant as Yahoo’s own Michael Santoli’s birthday

is November 2 and his Mom’s birthday is October 28. In other words, if

this works again this year, we can just start calling this one the

Detrick/Santoli seasonal buy signal.Thanks to James Smith for the photo.

No comments:

Post a Comment