Rapid Change caused by the Technological Singularity we have been entering since Roswell, Transistors and Microchips and Artificial Intelligence are going to be changing all things on earth faster and faster and faster. This is affecting insurance companies around the world a LOT!

Begin quote from:

Evan

Freely has been insuring global risks for years—through the 2008 market

meltdown, the 2002 crisis in Argentina, and the 1993 downturn in

Venezuela. Yet turmoil now seems to be coming at a more rapid pace than

he’s seen …

Photographer: Marlene Awaad/Bloomberg

Evan Freely has been insuring global

risks for years—through the 2008 market meltdown, the 2002 crisis in

Argentina, and the 1993 downturn in Venezuela.

Yet turmoil now seems to be coming at a more rapid pace than he’s seen before. “I’m more concerned today about political risk than ever,” says Freely, the global head of political risk and credit specialties at Marsh & McLennan Cos., the world’s largest insurance broker.

Rising populism in France, Germany, Denmark, and Greece has turned up the dial on his company’s barometer of turmoil in the region. That and other developments are pushing the market for political risk insurance toward $10 billion in 2018, up from $8.1 billion in 2015, according to a KPMG LLP report published last year. The consulting firm says demand has been spurred by companies looking for coverage against cyberattacks and terrorist events. KPMG reckons that cybersecurity insurance will be the fastest-growing segment of the market, increasing 20 percent a year from 2015 through 2018.

Terrorist and hacking threats are compounded by changes in attitudes. Many Europeans have become averse to free trade, to immigration, and to losing national identities, according to Freely’s group at Marsh & McLennan.

Geopolitical risks, meanwhile, could have a negative impact on investment returns, according to a majority of respondents to a February CFA Institute survey of almost 1,500 investment professionals. Among the risks they identify: the election of Donald Trump, Brexit, and the possible further fracture of the European Union.

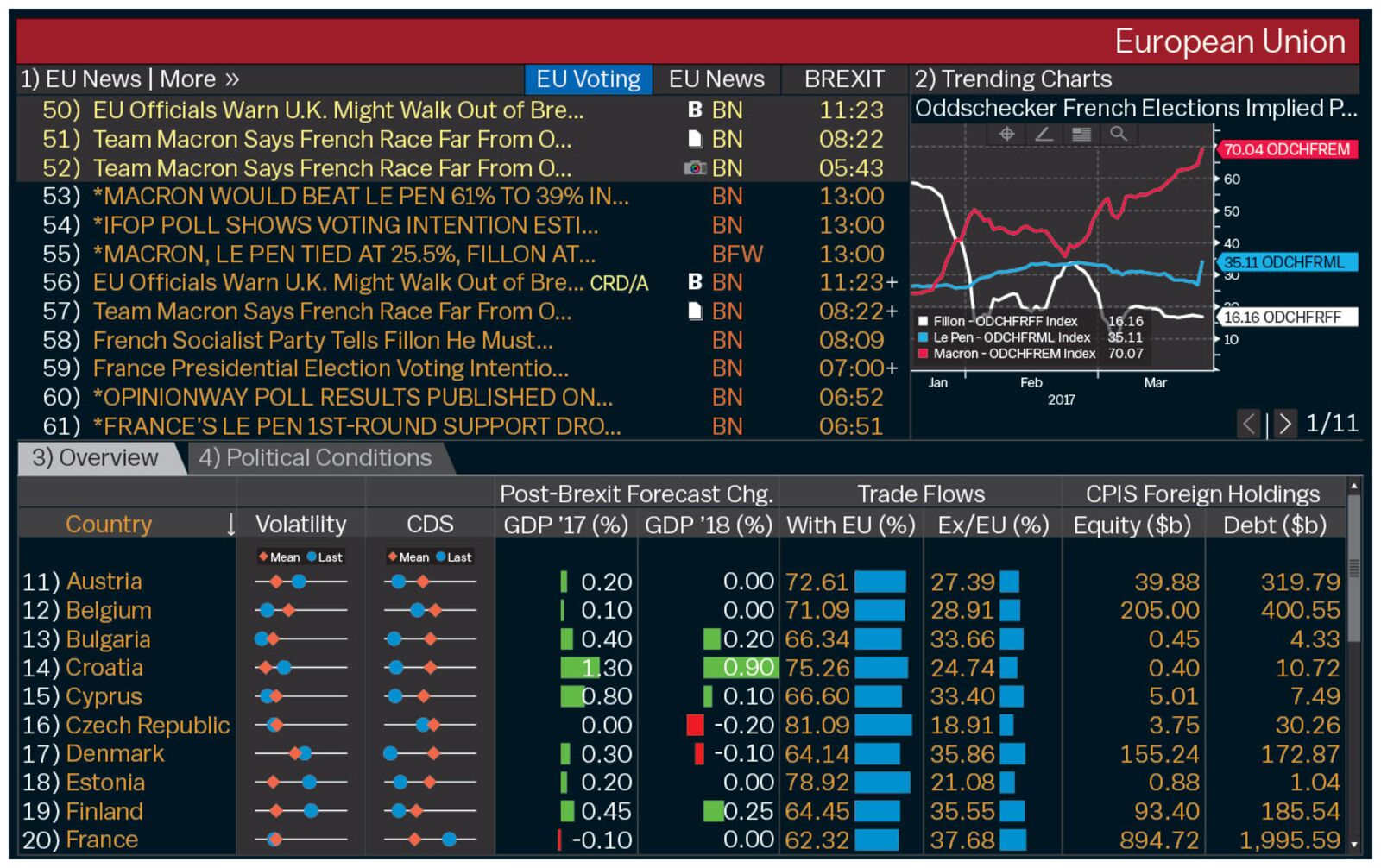

This year many investors have thus been closely following the French presidential campaign of Marine Le Pen, a far-right candidate who’s threatened to exit the euro zone and opposed EU sanctions against Russia over the Ukraine conflict as “counterproductive.” In polling for the first round of elections on April 23, Le Pen has led for stretches, with support of roughly 26 percent of French voters. Yet when it comes to the second round of voting, a runoff scheduled for May 7, she’s trailed rivals Emmanuel Macron and François Fillon in polling and betting markets.

Even if Le Pen loses her bid, populism in Europe and elsewhere is here to stay, observers say. How durable is the phenomenon? “Our view is that it’s structural,” says Alexander Kazan, managing director for emerging markets strategy and comparative analytics at Eurasia Group, a political risk consultant. He points to a falling trust in governments and institutions, especially among younger people, as well as decreasing support for political parties. That’s a view echoed by top hedge fund managers including Appaloosa Management’s David Tepper and Bridgewater Associates’ Ray Dalio, who, in a 61-page paper published in March, said populism could be a greater force in shaping markets over the next year than monetary or fiscal policies. By tracking the share of votes going to anti-establishment candidates in the developed world, Dalio determined that populism is at its highest levels since the 1930s.

Yet turmoil now seems to be coming at a more rapid pace than he’s seen before. “I’m more concerned today about political risk than ever,” says Freely, the global head of political risk and credit specialties at Marsh & McLennan Cos., the world’s largest insurance broker.

Rising populism in France, Germany, Denmark, and Greece has turned up the dial on his company’s barometer of turmoil in the region. That and other developments are pushing the market for political risk insurance toward $10 billion in 2018, up from $8.1 billion in 2015, according to a KPMG LLP report published last year. The consulting firm says demand has been spurred by companies looking for coverage against cyberattacks and terrorist events. KPMG reckons that cybersecurity insurance will be the fastest-growing segment of the market, increasing 20 percent a year from 2015 through 2018.

Terrorist and hacking threats are compounded by changes in attitudes. Many Europeans have become averse to free trade, to immigration, and to losing national identities, according to Freely’s group at Marsh & McLennan.

Geopolitical risks, meanwhile, could have a negative impact on investment returns, according to a majority of respondents to a February CFA Institute survey of almost 1,500 investment professionals. Among the risks they identify: the election of Donald Trump, Brexit, and the possible further fracture of the European Union.

This year many investors have thus been closely following the French presidential campaign of Marine Le Pen, a far-right candidate who’s threatened to exit the euro zone and opposed EU sanctions against Russia over the Ukraine conflict as “counterproductive.” In polling for the first round of elections on April 23, Le Pen has led for stretches, with support of roughly 26 percent of French voters. Yet when it comes to the second round of voting, a runoff scheduled for May 7, she’s trailed rivals Emmanuel Macron and François Fillon in polling and betting markets.

Even if Le Pen loses her bid, populism in Europe and elsewhere is here to stay, observers say. How durable is the phenomenon? “Our view is that it’s structural,” says Alexander Kazan, managing director for emerging markets strategy and comparative analytics at Eurasia Group, a political risk consultant. He points to a falling trust in governments and institutions, especially among younger people, as well as decreasing support for political parties. That’s a view echoed by top hedge fund managers including Appaloosa Management’s David Tepper and Bridgewater Associates’ Ray Dalio, who, in a 61-page paper published in March, said populism could be a greater force in shaping markets over the next year than monetary or fiscal policies. By tracking the share of votes going to anti-establishment candidates in the developed world, Dalio determined that populism is at its highest levels since the 1930s.

A more fragmented world may increase the potential to inflict damages across borders, Sanchez adds. In effect, populism could eventually feed back on itself, setting the stage for even more shake-ups.

Four Tools for Tracking Political RiskCalculating political risk is a qualitative exercise with a quantitative backdrop. Here’s how your terminal can help provide a better picture of the risk of doing business in countries such as France and the U.K. You can also get insight into European politics and markets at {EU

For aggregated news, data, and charts relating to European Union countries, run {EU }.

2

Go to {PRDTGVFR Index GP

3

Immigration has been a divisive issue in the French election. In 2015 the EU’s Eurostat reported that the foreign population in France was 7.9 million, or 11.9 percent of the total. The Fear Migration Index, a quantitative metric created by economists Scott Baker, Nicholas Bloom, and Steven Davis, is based on the frequency of keywords in news reports. Go to {ALLX FEPU

4

The Bank of England surveys market participants twice a year about systemic risk. In the survey covering the second half of 2016, the two risks cited as the most challenging to manage were U.K. political risk and cyberattacks. To chart the cyber risk data, run {UKRKCYB Index GP

Kochkodin is a managing editor at Bloomberg News in New York. Basak covers insurers in New York.

This story appears in the April/May 2017 issue of Bloomberg Markets magazine.

No comments:

Post a Comment