-

Russia dumped 84% of its American debt. What that means

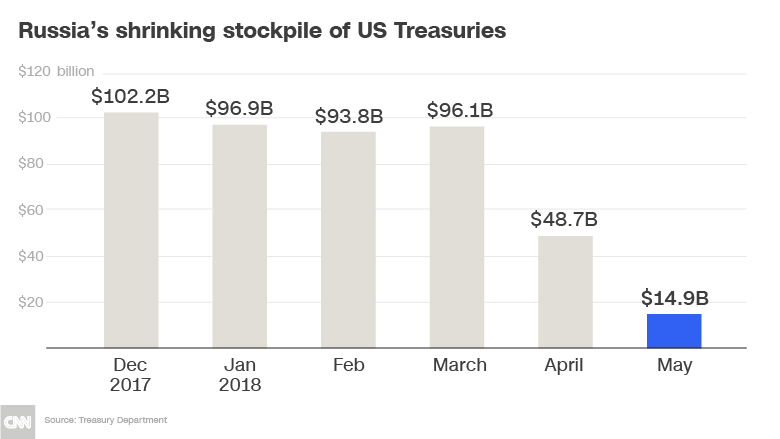

Russia has rapidly sold off the vast majority of its stash of American debt.

Between March and May, Russia's holdings of US Treasury bonds plummeted by $81 billion, representing 84% of its total US debt holdings.The sudden debt dump may have contributed to a short-term spike in Treasury rates that spooked the market. 10-year Treasury yields topped 3% in April for the first time since 2014.It also sparked a guessing game about Moscow's motivations. Maybe Russia just wanted to diversify its portfolio, as the central bank stated. Or perhaps Russia was seeking revenge for Washington's crippling sanctions on aluminum maker Rusal.'Not particularly alarming'

Either way, there's little debate over the long-term impact. Russia's selling has not hurt America's ability to borrow money.That's because investors -- particularly life insurers and pension funds that serve aging baby boomers -- have a big appetite for fixed income. Treasury rates quickly descended back below 3% because demand for bonds continued to grow.

The limited impact from Russia's selling makes sense. It's not a leading creditor of the United States. China is.Even at Russia's recent peak of $105.7 billion in November 2017, it only ranked as the 15th biggest foreign holder of US debt. China owns about $1.2 trillion -- or roughly 10 times as much as Russia."It's not particularly alarming," said Guy LeBas, chief fixed income strategist at Janney Capital.Eugene Chausovsky, senior Eurasia analyst at consulting firm Stratfor, agreed that Russia's move away from US debt "is not a huge deal.""If we had this kind of sell-off from China, this would be a completely different picture," he said.New numbers on foreign ownership of US Treasuries are set to be released on August 15.Russia provided an innocent response to questions about the Treasury sales."We have increased the share of gold in recent years, almost tenfold in ten years, so we are diversifying the entire structure of currencies," Elvira Nabiullina, the head of Russia's central bank, told state media earlier this month.Nabiullina added that Russia assesses "all the risks: financial economic and geopolitical."Crushing sanctions on Rusal

Of course, geopolitical tensions between the United States and Russia spiked around the time that its Treasury sales accelerated.In April, the Trump administration imposed tough sanctions on Rusal, the aluminum company founded by one of Vladimir Putin's closest allies. The penalties initially prohibited Americans and people from other countries from doing business with Rusal, which produces 7% of the world's aluminum. Aluminum prices soared on the news."Rusal's exports were essentially paralyzed. It was a much more vicious kind of sanction than what was previously imposed on Russia," said Jason Bush, an analyst at consulting firm Eurasia Group."One theory is that this was Russia's revenge for US sanctions," said Bush.If so, the damage was relatively minor given the rebound in the US Treasury market. The Trump administration recently said it's looking into lifting sanctions against Rusal.Another theory is that Moscow feared further US sanctions that could cause its holdings of US debt to be frozen or even seized."So Russia may have been running for the exit to avoid that threat. That's a more plausible argument," said Bush.In reality, analysts said it was likely a combination of political pressure from the Kremlin and economic arguments that caused Russia's central bank to back away from US Treasuries.'Economic attack' on America

The Russia situation underscores long-running concerns that a major US creditor could threaten to hurt America by dumping debt. Those worries have been heightened by America's soaring federal budget deficit and the ongoing trade war with China.But analysts question the logic behind this worry. China would struggle to unload that much debt at once -- and its own portfolio would dramatically lose value during such a fire sale."The idea of weaponizing foreign-exchange holdings for an economic attack on the United States is just as likely to hurt the weaponeer," said Janney's LeBas.The bigger risk is that China or another country weans itself off US debt by slowing its purchases and waiting for existing Treasuries to mature."Gradualism could have a long-term impact on the United States. But that would be a patient policy that would not reveal itself easily," said David Kotok, chairman of Cumberland Advisors.

To the best of my ability I write about my experience of the Universe Past, Present and Future

Top 10 Posts This Month

- Trump to make announcement with Hegseth on shipbuilding from Mar-a-Lago

- Here's how much ACA premiums would have risen this year without tax subsidies:

- How the global food system is impacting obesity and climate change: Study

- quote from Wikipedia: Mark Carney

- As storms inundated Washington state, federal grants for flood mitigation work sat on hold

- gold has surged 70% since the Start of the Year

- Deputy AG says removing photos from Epstein files has 'nothing to do' with Trump(Sure thing) (ha ha)

- reprint of: My Path to Enlightenment from 2011

- is the storm hitting California a pineapple express?

- What is the main weakness of a Subaru 2017 PZEV engine: The Oil Seals and Gaskets. Why? (Part 2)

Monday, July 30, 2018

Russia dumped 84% of its US debt. Here's what that means

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment