Markets

Currency War Erupts, Threatening to Ripple Across Global Markets

By

Updated on

- Trade fight spreads to FX as president talks down dollar

- Currency war would put equities, oil, and EM assets at risk

Trump Says China, EU Are Manipulating Their Currencies

The currency war has arrived.

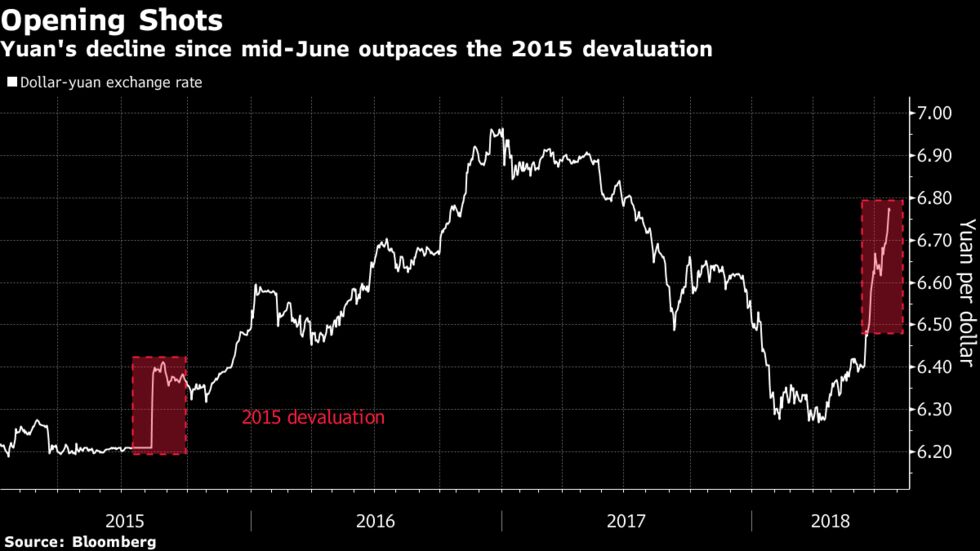

So say some of the best and brightest in the $5.1 trillion-per-day foreign-exchange market. U.S. President Donald Trump took to Twitter Friday to accuse China and the European Union of “manipulating their currencies and interest rates lower.” The comments came after the yuan on Friday plunged past 6.80 per dollar for the first time in a year and as the nation’s central bank shows little sign of intervening to stem the slide. Treasury Secretary Steven Mnuchin said the government is closely monitoring whether China has manipulated its currency, according to Reuters.

As the world’s two largest economies open up a new front in their increasingly acrimonious game of brinkmanship, the consequences could be dire -- and ripple far beyond the U.S. and Chinese currencies. Everything from equities to oil to emerging-market assets are in danger of becoming collateral damage as Beijing and Washington threaten the current global financial order.

“The real risk is that we have broad-based unravelling of global trade and currency cooperation, and that is not going to be pretty,” said Jens Nordvig, Wall Street’s top-ranked currency strategist for five years running before founding Exante Data LLC in 2016. “Trump’s rhetoric over the last 24 hours is certainly shifting this from a trade war to a currency war.”

China’s shock devaluation of the yuan in 2015 provides a good template for what the contagion might look like, according to Robin Brooks, the chief economist at the Institute of International Finance and the former head currency strategist at Goldman Sachs Group Inc. Risk assets and oil prices would likely tumble as worries about growth arise, hitting currencies of commodity-exporting countries particularly hard -- namely, the Russian ruble, Colombian peso and Malaysian ringgit -- before taking down the rest of Asia.

“Asian central banks will initially try to stem currency weakness through intervention,” Brooks said. “But then Asian central banks will step back, and in my mind, the big underperformer on a six-month horizon could be EM Asia.”

Whether the People’s Bank of China attempts to anchor the dollar-yuan exchange rate near 6.80 to avoid further escalation is key, according to Nordvig. He says European Central Bank President Mario Draghi may elect to step into the fray at the ECB’s July 26 policy meeting, given American attempts to talk the dollar down in January were extremely unpopular in Frankfurt.

The Bloomberg Dollar Spot Index fell as much as 0.8 percent Friday, the most since March. The euro ended the day up 0.7 percent at $1.1724, while the yen was almost 1 percent stronger.

“There’s no question that the weakening of the currency creates an unfair advantage for them,” Mnuchin said of China, according to Reuters. “We’re going to very carefully review whether they have manipulated the currency.”

The Treasury Department declined to comment when asked whether the U.S. was entering a currency war.

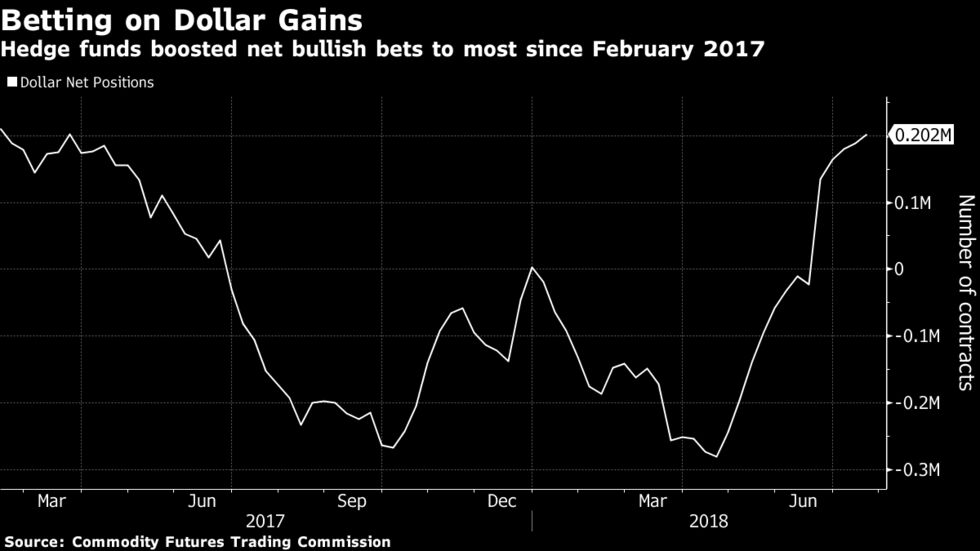

The greenback will likely continue to suffer as investors heed Trump and back out of long dollar wagers, according to Shahab Jalinoos, Credit Suisse Group AG’s global head of FX trading strategy.

Hedge funds and other speculators are the most bullish on the currency since February 2017, according to data released Friday from the Commodity Futures Trading Commission that tracks positions through the week ended July 17.

“It has now been virtually defined as a currency war by the U.S. president, given that he explicitly suggested foreign countries are manipulating exchange rates for competitive purposes,” Jalinoos said. “The barrage of commentary will likely force the market to scale back long dollar positions.”

— With assistance by Saleha Mohsin, and Lananh Nguyen

end quote from:

https://www.bloomberg.com/news/articles/2018-07-20/currency-war-erupts-as-trump-blasts-china-eu-for-manipulating

No comments:

Post a Comment