| Bloomberg | - |

Asian

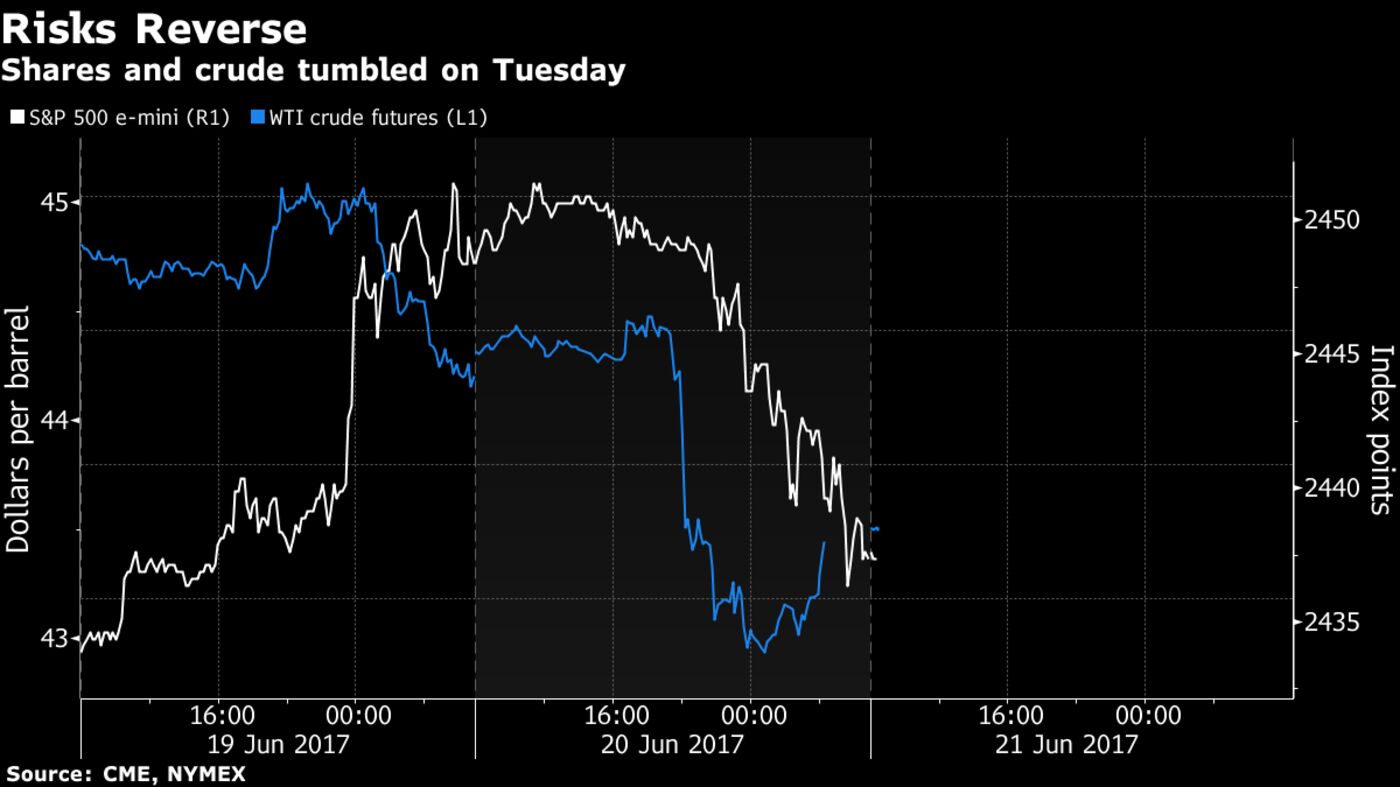

shares retreated as crude oil tumbled into a bear market on concern a

global supply glut will persist. Shanghai equities fluctuated after MSCI

Inc. added China's domestic stocks to its emerging-markets index.

Oil Slide Hits Stocks; China Shares Swing on MSCI: Markets Wrap

By-

Shanghai equities fluctuate while Hang Seng index retreats

-

Crude tumbles into bear market on supply glut concerns

Oil Dips on Global Glut Concerns

Australia’s benchmark stocks index led losses in the region, with energy shares falling more than 2 percent, after the biggest drop in the S&P 500 Index since May 17. The Shanghai Composite Index swung between gains and losses after the MSCI’s move, while Hong Kong shares retreated. Oil edged lower after sliding to the lowest level since November on Tuesday. Gold rose after a five-day selloff.

The MSCI decision will add 222 China A-share stocks starting in May 2018. The nation’s $6.8 trillion onshore market is the world’s second largest and accounts for 9 percent of global stock value, but had been rejected for index inclusion three times by MSCI over issues including capital controls and long trading halts.

The index provider delayed its decision on the status of Argentina’s equities, dealing a blow to investors as bearish bets on the Merval benchmark index jumped to a high and Argentine shares in the U.S. plunged. MSCI also will consult on the possible inclusion of Saudi Arabia in the index.

Stocks had barreled to fresh highs after a series of geopolitical concerns seems to have faded, though formal negotiations over Britain’s exit from the European Union began somewhat contentiously.

Here are some of the key upcoming events:

- Still to come on the Fed speaker list: Eric Rosengren, Robert Kaplan, Jerome Powell, James Bullard and Loretta Mester.

- BOJ Governor Haruhiko Kuroda will speak in Tokyo and ECB board member Benoit Coeure speaks in Frankfurt on Wednesday.

- Malaysia is expected to report that inflation slowed in May.

- New Zealand’s central bank is expected to leave its benchmark interest rate at a record low when it meets on Thursday.

Here are the main moves in markets:

Stocks

- The Shanghai Composite rose 0.1 percent as of 12:01 p.m. in Tokyo, after retreating 0.2 percent earlier. Hong Kong’s Hang Seng lost 0.6 percent and the Hang Seng China Enterprises Index fell 0.6 percent.

- Australia’s S&P/ASX 200 Index slumped 1.3 percent, with BHP Billiton Ltd. and Rio Tinto Ltd. sliding at least 2.8 percent.

- Japan’s Topix fell 0.1 percent, after climbing for three days to the highest level since August 2015. South Korea’s Kospi dropped 0.6 percent.

- ADRs for YPF SA, Argentina’s state-run oil producer, slumped 10 percent in after-hours U.S. trading amid disappointment over MSCI’s decision. Grupo Financiero Galicia SA lost 5.8 percent.

- Contracts on the S&P 500 dropped 0.2 percent. The gauge’s retreat on Tuesday was led by energy stocks and consumer discretionary producers, which slumped 1.3 percent. The Stoxx Europe 600 erased a gain to end 0.7 percent lower.

- West Texas oil declined 0.2 percent to $43.44, after tumbling 2.2 percent on Tuesday and touching the lowest since August. Crude is down more than 20 percent from its high for the year reached in February.

- Gold rebounded 0.2 percent to $1,245.31 an ounce, after falling for five straight days.

- The yen rose 0.2 percent to 111.28 per dollar, after gaining 0.1 percent on Tuesday. It had retreated 0.6 percent the previous session.

- The Bloomberg Dollar Spot Index was flat after rising 0.3 percent on Tuesday and 0.4 percent the previous day. The measure touched the lowest level since October last week.

- The British pound was little changed at $1.2628, after Tuesday’s 0.8 percent drop. Bank of England Governor Mark Carney said he is still worried about the impact of Brexit on the economy.

- The yield on 10-year Treasuries was little changed at 2.16 percent, after falling three basis points on Tuesday.

- Australian 10-year yields declined two basis points to 2.40 percent.

No comments:

Post a Comment