- 1 day ago ... Riskier borrowers are making up a growing share of new mortgages, pushing up delinquencies modestly and raising concerns about an ...

- 20 hours ago ... A BAD IDEA': MORE NEW MORTGAGES ARE RISKY ONES. Potential for more defaults could derail the housing recovery. Chicago Sun-Times ...

- 10 hours ago ... Riskier borrowers are making up a growing share of new mortgages, pushing up delinquencies modestly and raising concerns about an ...

- 13 hours ago ... 'A bad idea': More new mortgages are risky ones. Posted by: ... ago 0 1 Views. Delinquencies on FHA-backed mortgages ticked up recently.Riskier borrowers are making up a growing share of new mortgages, pushing up delinquencies modestly and raising concerns about an eventual spike in defaults that could slow or derail the housing recovery.Nebraska is the rated highest among states for housing affordability. Vermont offers a good employment landscape for under-35 home buyers. Newslook

The trend is centered around home loans guaranteed by the Federal Housing Administration that typically require down payments of just 3% to 5% and are often snapped up by first-time buyers. The FHA-backed loans are increasingly being offered by non-bank lenders with more lenient credit standards than banks.

The landscape is nothing like it was in the mid-2000s when subprime mortgages were approved without verification of buyers' income or assets, setting off a housing bubble and then a crash. And Quicken Loans, one of the largest FHA lenders, dismisses the concerns as overwrought. Still, for some analysts, the latest development is at least faintly reminiscent of the run-up to that crisis.

“We have a situation where home prices are high relative to average hourly earnings and we’re pushing 5%-down mortgages, and that’s a bad idea,” says Hans Nordby, chief economist of real estate research firm CoStar.

The share of FHA mortgage payments that were 30 to 59 days past due averaged 2.19% in the fourth quarter, up from about 2.07% the previous quarter and 2.13% a year earlier, according to research firm CoreLogic and FHA. That’s still down from 3.77% in early 2009 but it represents a noticeable uptick.

While that could simply represent monthly volatility, “the risk is that the performance will continue to deteriorate and then you get foreclosures that put downward pressure on home prices,” says Sam Khater, CoreLogic’s deputy chief economist. Such a scenario likely would take a few years to play out.

The early signs of some minor turbulence in the mortgage market add to concerns generated by recent increases in delinquent subprime auto loans, personal loans and credit card debt as lenders target lower-income borrowers to grow revenue in the latter stages of the recovery.

FHA mortgages generally are granted to low- and moderate-income households who can’t afford a typical downpayment of about 20%. In exchange for shelling out as little as 3%, FHA buyers pay an upfront insurance premium equal to 1.75% of the loan and 0.85% annually.

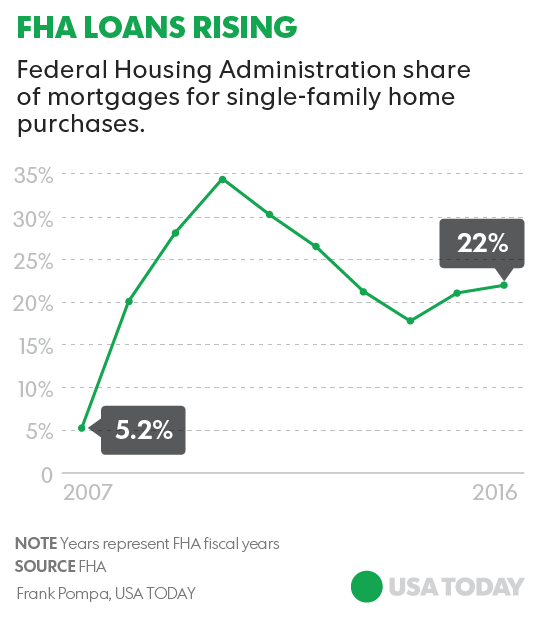

FHA loans made up 22% of all mortgages for single-family home purchases in fiscal 2016, up from 17.8% in fiscal 2014 but below the 34.5% peak in 2010, FHA figures show.

The share has climbed largely because of a reduction in the insurance premium and home price appreciation that has made larger downpayments less feasible for some, says Matthew Mish, executive director of global credit strategy for UBS. House prices have been increasing about 5% a year since 2014.

At the same time, the nation’s biggest banks, burned by the housing crisis and resulting regulatory scrutiny, largely have pulled out of the FHA market as the costs and risks to serve it grew. Non-bank lenders, which face less regulation from government agencies such as the FDIC, have filled the void.

Non-banks, including Quicken Loans and Freedom Mortgage, comprised 93% of FHA loan volume last year, up from 40% in 2009, according to Inside Mortgage Finance. Meanwhile, the average credit score of an FHA borrower fell to 678 in the fourth quarter from 693 in 2013, according to FHA, below the 747 average for non-FHA borrowers. Mish says non-banks generally have looser credit requirements, and lenders have further eased standards – such as the size of a monthly mortgage payment relative to income – as median U.S. wages stagnated even as home values marched higher.

Here’s the worry: If home prices peak and then dip, homeowners who put down just 5% and are less creditworthy than their predecessors will owe more on their mortgages than their homes are worth. That would increase their incentive to default, especially if they have to move for a job or face an extraordinary medical or other expense, Khater says. Foreclosures would trigger price declines that ignite more defaults in a downward spiral.

In turn, funding for the non-bank lenders from banks and hedge funds likely would dry up, and FHA loans would be harder to get, dampening the housing market and the broader economy, Mish says.

Guy Cecala, publisher of Inside Mortgage Finance, says such fears are unfounded, noting Federal Reserve officials have complained that FHA loan standards have been too rigorous.

“The non-banks are bringing a welcome change,” he says. They still must meet FHA standards, he says, and are regulated by agencies such as the Consumer Financial Protection Bureau.

Bill Emerson, vice chairman of Quicken Loans, the largest non-bank lender, says the credit standards of his firm and his peers are actually stringent by historical standards and appear looser only because banks sharply tightened their requirements after the housing crash.

“I don’t have any concerns about” a potential increase in delinquencies or defaults, Emerson said in an interview. “In the last three, four years, consumers have more access to credit….and all of a sudden it’s, ‘Here we go again.’ Likening the mid-2000’s meltdown to a 100-year flood, he added, “I don’t believe we’re anywhere close.”

To the best of my ability I write about my experience of the Universe Past, Present and Future

Top 10 Posts This Month

- As storms inundated Washington state, federal grants for flood mitigation work sat on hold

- Here's how much ACA premiums would have risen this year without tax subsidies:

- Trump to make announcement with Hegseth on shipbuilding from Mar-a-Lago

- What are the real Truths of Life?

- Deputy AG says removing photos from Epstein files has 'nothing to do' with Trump(Sure thing) (ha ha)

- gold has surged 70% since the Start of the Year

- Remembering the treasured films of Rob Reiner

- Judge orders plan to return ex-CECOT detainees to U.S. or give them hearings 3H ago

- Shark attack? at Lover's point in California today Sunday December 21st 2025 (Monterey Area)

- Hassett says $2,000 tariff checks for Americans will depend on Congress

Monday, March 13, 2017

Another Great Recession or Worse from all the risky loans?

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment